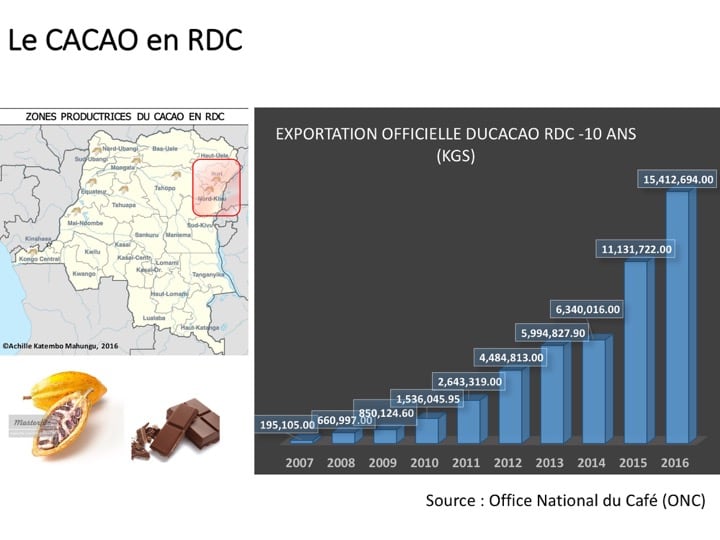

The Democratic Republic of Congo (DRC) exported just 600 MT of cocoa in 2000, but exports have since grown exponentially to reach 10,000 MT in 2014/15 with further growth anticipated.

History of cocoa in DRC

Cocoa was introduced to the DRC in the late 19th century when the country was the private colony of Belgium's King Leopold II. Organized cocoa plantations began in the 1920-30s after DRC became a Belgian colony with plantings of around 20,000 ha along the Congo River. At this time, production was concentrated in Western DRC. Cocoa production peaked shortly before DRC gained independence in 1960 with an estimated 25,000 ha of planted area, and then plateaued after the colonial owners of the cocoa plantations left the country. Cocoa’s resurgence began around 10 years ago.

Source: ASSECCAF interview

The majority of DRC cocoa is double certified to UTZ and organic/bio standards.

Organic chocolate opportunity

Kevin Wilkins, cocoa and coffee sector lead for ELAN RDC, a £50m ($65m) project to drive market development in the DRC, told this site: "Organic certification and UTZ are largely the foundations of the cocoa market here. That positions Congo well as demand for organic chocolate grows.”

Organic chocolate sales are projected to rise in countries such as France. It comes as organic cocoa only accounts for roughly 0.5% of global production with the Dominican Republic and Peru as the main organic cocoa producers.

Heavy investment in the cocoa sector

Wilkins, who was previously the director of GrowCocoa, a joint venture of Blommer Chocolate and Olam International, said: “Congo really is open for business and it is fertile ground for investments."

ÉLAN RDC is funded by the UK government’s Department for International Development (DFID) and implemented by Adam Smith International (ASI). In cocoa, it is working to improve production practices to boost yields and bolster quality, increase access to finance and to establish networks of buying, fermentation and drying centers.

Theo Chocolate sources around 70% of its cocoa from the DRC. Since 2011, it has collaborated with the Eastern Congo Initiative – a charity founded by actor Ben Affleck – to source at least 1,600 MT of DRC cocoa to date.

Japanese cocoa ingredients and chocolate supplier Tachibana is also sourcing from Equateur province in the DRC.

"All of these efforts and investments are geared towards ensuring an increasingly consistent crop, quality, and uptick in the [production] numbers” said Wilkins.

Opportunity for bulk cocoa

ESCO, the majority exporter of cocoa in the country, has been instrumental in boosting DRC cocoa production.

Kambale Kisumba Kamungele, president of ASSECCAF, an association of cocoa and coffee exporters in the DRC, told us cocoa was cultivated by commercial plantations during colonial rule in the early 20th century and then faded after independence in 1960.

Cocoa’s resurgence began after coffee growers in Eastern DRC were hit by coffee wilt disease in the late 1990s, he said.

ESCO, owned by a British family, started to introduce cocoa to these regions, trained farmers and distributed planting materials about 10-15 years ago.

"The emergence of cocoa in the DRC is mostly coming from Eastern parts of the DRC," said Kamungele.

This differs to cocoa under colonial rule, which was concentrated in the West.

Wilkins said ESCO’s work to build a network of around 30,000 cocoa producers attracted speciality buyers such as Theo Chocolate.

"The speciality market got that buzz going... We're starting to see more movement not just on the speciality front, but on the bulk front for both cocoa and coffee," he said. "The focus has really been in speciality, but there's a huge opportunity in bulk."

Transforming lives: A story to tell

Kamungele said cocoa was transforming the lives of people that had experienced decades of conflict and poverty.

Conflict has been rife in Eastern DRC for the past two decades. Rwanda-backed rebels invaded the DRC (then Zaire) in 1996, beginning the First Congo War and ending the 32-year rule of president Mobutu.

Opposition leader Laurent-Désiré Kabila took power in 1997 and renamed the country the DRC. Military groups and Ugandan-backed militia sought to overthrow Kabila in the Second Congo War, starting in 1998.

Kabila was assassinated in 2001. His son Joseph Kabila succeeded him and eventually became president in 2006 after disputed elections.

Rebel groups, including the now demobilised March 23 Movement (M23), have contested Kabila’s rule ever since, leading to conflict in Kivu provinces.

Violence and crisis in the DRC have caused an estimated 5.4 million deaths in a population of 67 million since 1998, according to the International Rescue committee.

"In a region which is war torn, the introduction of cocoa has been something that has improved the lives of many families,” said Kamungele.

Wilkins said: "There’s a lot intrigue around the origin. Respecting DRC’s storied history and being able to tell that story is important, but we must also convey progress and opportunity. These are important elements we balance when it comes to marketing across specialty and bulk markets.”

A farmer in North-Kivu can generate $800-$1,900 per year from cocoa alone based on prices since July 2016.

This may bring them above the average annual GDP per capita in the DRC of $800, according to CIA data, and North-Kivu farmers may gain additional income from other activities as cocoa is often intercropped with bananas.

Resilient to political unrest

Kamungele added cocoa in the DRC had been quite resilient to political unrest in the country, which can disrupt mining industries.

"Even if rebel movements come and people flee, the plants will still be there and when they come back, it's just a matter of pruning and the cocoa will continue to grow,” he said.

Growing regions

North-Kivu is DRC’s main cocoa growing region. There are two main growing areas: Old planted surfaces of western DRC, dating back 70-80 years, and recently planted area in eastern DRC, from the early 2000s (Nord-Kivu & part of Ituri Provinces). ASSECCAF estimates the DRC cocoa surface is around 65,500 ha, with 15,000 ha in the provinces of Equateur and Bas-Congo (Kongo Central) and 50,000 ha mainly in Nord-Kivu Province and Ituri. Genetic mapping by ECI and Mars indicates the majority of DRC cocoa comes from Forastero clones, but a number of Trinitario trees are also present.

Untapped production zones

DRC cocoa production is expected to climb further, driven by rehabilitation projects, recent investment and ramping up of certification.

"This year (2016-2017) we are going to be looking at somewhere around 16,000 MT [regulated exports]," said Dimitri Moreels, director of COPAK, a cocoa exporter and ASSECCAF member.

Wilkins said: "And there are untapped zones. There's an abundance of arable land for production here. For instance, there’s a huge opportunity in Bas-Congo (Kongo Central).”

Kamungele added: "There's big potential in rehabilitation in Western DRC - it's very suitable for cultivation, but it's been abandoned."

Association of exporters

ASSECCAF was founded around 10 years ago with a regional office in Eastern DRC, but became a national platform for coffee and cocoa in 2015. The organization has 18 members with 10 active in cocoa export. A separate private industry trade group, Comité Professionnel Café & Cacao-Fédération des Entreprises du Congo (FEC) is also promoting DRC cocoa exports.

Bean & Co, a public company incorporated in London and owned by Israeli agribusiness firm LR Group said last year at an industry event that it intends to develop a commercial cocoa plantation in the DRC.

"We think pretty soon we will be reaching more than 20,000 MT [in DRC cocoa exports]," said Kamungele.

He said ASSECCAF had successfully pushed the national regulator to reduce cocoa export charges from roughly 4.2% tax on the Free On Board (FOB) price to 3% from last year to reduce cocoa volumes smuggled to Uganda.

Actual cocoa production in DRC may be far higher than the regulated export figures – perhaps even double at between 33,000 MT and 35,000 MT, according to ASSECCAF estimates.

This is because significant volumes are smuggled to neighbouring Uganda, where export taxes are lower.

Key export markets

DRC has no grinding capacity. Its cocoa tends to be transported 1,200 km to the port of Mombasa in Kenya.

Switzerland is the main destination, followed by Belgium. But the American market is showing increased interest, said Kamungele.

Much of the DRC cocoa processed in Europe ends up in finished chocolate in Asia.

Average yields

ASSECCAF estimates average annual yields in Nord-Kivu and parts of Ituri are around 1.2 MT per ha, due to farmer training and post-harvest processing by ESCO and COPAK. This is higher than the global average annual yields per hectare of 0.5 MT per ha in 2013, according to ICCO data.

Average annual yields are lower in DRC’s Equateur province at around 0.2 MT per ha as rehabilitation and private investment projects have yet to really get underway, says ASSECCAF.

Kamungele said, based on buyer feedback, cocoa quality for chocolate is high in Eastern DRC due to fermentation infrastructure and agricultural training, while quality is lower in Western DRC, where the market is still developing, despite a higher bean count per pod.

"With Olam being in Uganda... I think more and more will be going to Asia, but I see also the trend in organic going mostly to the European and American markets," said Kamungele.

None of the three major cocoa and chocolate ingredients firms are present in DRC cocoa, although Barry Callebaut is showing some initial interest, according to COPAK.

Olam also acquired speciality coffee supplier Schluter in October 2016, which operates in the DRC in coffee under the name Virunga Coffee. Olam itself is also active in cocoa in neighbouring Uganda.