The 4th World Cocoa Conference, which took place last week in Germany, ended with the Berlin Declaration, a statement based on feedback from the 1,500 delegates, including industry, farmer cooperatives, civil society organizations and governments.

The declaration said efforts since 2012 “have not been enough to achieve significant impact at scale”.

“We affirm that the cocoa sector will not be sustainable if farmers are not able to earn a living income….All stakeholders should develop and implement policies that enable cocoa farmers to make a living income,” it said, among several other recommendations.

‘There are important challenges that remain’: WCF president

Speaking to ConfectioneryNews in Berlin, Rick Scobey, president of the World Cocoa Foundation (WCF), said: "We all agree that there are important challenges that remain despite years and billions of dollars of effort."

Scobey said boosting farmer income and diversifying revenue through intercropping and other activities is a top priority for all stakeholders in the sector.

“This is new work for the companies and we're really beginning to pilot and partner with governments, development partners, and research institutions to find what is the best mix of alternate income generating work,” he said.

‘Sustainable livelihoods’ under CocoaAction

CocoaAction, a joint sustainability platform launched in 2014 to align the programs of nine leading chocolate and cocoa players, including Mars, Nestlé and Mondelēz, will be reviewed within the next year.

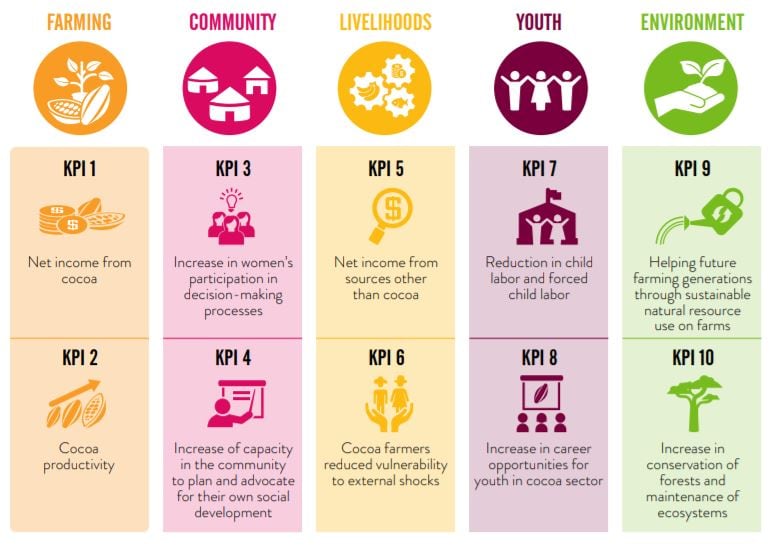

CocoaAction does not currently compel members to report income data from company programs and has no key performance indicator (KPI) on ‘living income’ or ‘sustainable income’ for farmers.

Company commitments

None of the top six chocolate companies or big three cocoa ingredient suppliers have committed to providing a living income to cocoa farmers. However, Barry Callebaut has pledged to lift 500,000 farmers in the cocoa supply chain above the poverty line by 2025.

But Scobey said: “Income is very much an objective of CocoaAction and WCF’s work.

“Our goal is to professionalize farmers and improve their productivity and profitability and we do that with a heavy focus on trying to double their yields so they'll have more volume for the market.

"When we review CocoaAction and the WCF strategy, we are putting 'sustainable livelihoods' at the center of our vision.

“…I think measuring net income from all the companies’ programs and governments for cocoa productivity is the top indicator for sector impact.”

Above the poverty line and beyond

WCF intends to review CocoaAction within the next year once it has analyzed second-year impact data in June and July of this year.

Scobey said: "Our first and most important target is to raise farmers above the poverty line, which we follow against the World Bank extreme poverty line ($1.90 a day).”

“Second we want to make sure that they have sufficient income beyond mere poverty existence requirements...meaning there's enough for school fees, for crop inputs, housing, health, and safe water and sanitation,” said Scobey.

What is a ‘living income’?

Fairtrade and True Price recently calculated a living income for a cocoa farmer in Côte d’Ivoire, adjusted for tax, as $6,133 per year. The figure was based on a medium household of eight and equates to $2.10 per person a day.

Fairtrade found average Ivorian cocoa farmer household income was $2,707 per year, with around $2,000 of income coming from cocoa, according to its survey of 3,202 Fairtrade certified farmers. This equates to total income of $0.93 per person a day.

“The benchmark [$6,133] informs the calculation of a preliminary living income reference price for cocoa which we plan to publish with the release of the second part of Fairtrade Minimum Price and Premium consultation for cocoa in the coming weeks,” Jon Walker, senior advisor for cocoa at Fairtrade, told this site.

“The research reconfirms the urgency for us and we hope for other actors in the cocoa sector to intensify our collective efforts towards achieving sustainable livelihoods for cocoa farmers,” he added.

Separately, ISEAL, the Sustainable Food Lab and GIZ plan to publish living income benchmarks for cocoa growing communities in Côte d’Ivoire and Ghana under the ‘Living Income Community of Practice’ initiative by August 2018. See HERE for more details.

Mondelēz warns of artificially keeping families in cocoa

Cathy Pieters, director of Mondelēz’s Cocoa Life program, said she hopes a focus on ‘sustainable livelihoods’ will allow the industry to look beyond price and premiums.

"I sometimes wonder if there is a danger in just looking at the price [or premium],” she said in an interview in Berlin.

Cocoa Life: Income is already a KPI

Mondelēz is one of the few chocolate companies using farmer net income as a key performance indicator (KPI) in its sustainability program, according to Pieters.

The Cadbury maker has reported Cocoa Life farmers in Indonesia averaged total net income of $1.698 ($630 from cocoa) in 2016, up 143% from baseline data collected in 2015. The company plans to publish income data for Cocoa Life in Ghana and Côte d’Ivoire in Q4 2018. Around 35% of the Milka owner’s annual cocoa volumes are covered by Cocoa Life.

“If we look at that in isolation, we're creating a dependency and that's not what we want to achieve in the long term.”

"… I think we might be artificially keeping families in cocoa who might be better off in other things had they been given the choice."

She suggested government agricultural reforms should provide choices to farmers and help them get out of cocoa if it is unlikely to provide a sustainable livelihood.

"I sometimes have the feeling we keep putting on band-aids to try to 'save the smallholder'. I think we should have a serious discussion with governments to see how we really look at the future."

Productivity focus not to blame for cocoa price crash, says WCF president

The Cocoa Barometer – published this month by a group of NGOs including the Voice Network and Solidaridad – suggested the industry’s current focus of boosting farm productivity contributed to an oversupply and a global market price decline.

“More than a third of [cocoa’s] value was wiped out, with a ton of cocoa going from above $3,000 to below $1,900 in a matter of months.

“Despite various voices warning that a focus on production increase policies would lead to a price collapse, most companies and governments were not prepared when it happened,” said the Barometer.

The report said smallholder cocoa farmers consequently saw their income decline around 30-40% year-on-year.

WCF’s Scobey said increased productivity was not the culprit since the industry has yet to realize increased yields per hectare in company sustainability programs.

"We've not seen any big increase as a result of on farm productivity measures yet,” he said.

"First year data [from CocoaAction] doesn’t show any significant increase in per capita production levels, they are still relatively low at 300-400 kg per hectare," which has been the level of the last 10 years, said the WCF president.

He contended most of the surplus came from expansion of the cocoa area, particularly into protected forests.

Asked why CocoaAction’s focus of growing more cocoa on less land had not yet led increased yields per hectare, Scobey said:

"...This is a long journey to really professionalize and train farmers. It's not going to be done overnight - it takes time and effort."

Only 2% of farmers reached by CocoaAction have adopted the initiative’s full productivity package mainly because farmers struggle to finance fertilizer-use and farm rehabilitation. See HERE for more details.

WCF hopes to improve adoption rates by providing capital for farmers through the United Nations’ Impact Investment Fund for Land Degradation Neutrality and has launched a separate fertilizer research program – the ‘CocoaSoils Initiative’ – to tackle low-use of fertilizers.

What about cocoa price volatility?

Cocoa prices are rising following last year’s slump.

Cocoa prices averaged $2,625 per ton last month, according to ICCO's monthly averages of daily prices on the combined London and New York futures exchanges, up 34% compared to April last year.

Rabobank said in its latest Agri Commodity Monthly report there has been heavy speculative trading amid the threat of an El Niño weather event and strong grind demand. Côte d’Ivoire will review farm gate prices ahead of the main crop (October to March 2018) based partly on the futures market.

The Berlin Declaration said: “Global price volatility and low farm gate prices have had a strong negative impact on the sector”

It recommended producing country governments “coordinate national and regional cocoa policies, specifically being mindful of the impact this can have on cocoa prices.”