Mintel: Natural and clean-label trend still driving NPD

The number of new products making natural claims increased steadily in all regions between 2005 and 2009, while those making ‘minus’ or ‘plus’ claims had dipped as a percentage of new products, said Mintel director of innovation and insight David Jago.

The percentage of new products launched globally containing natural claims (including ‘no artificial colours/flavours/preservatives/additives’ claims) rose from just over a quarter of new launches in 2005 to well over a third in 2009, while the percentage containing ‘green’ messages had risen from virtually none to well over 10% of new products, revealed Jago.

Over the same period, the percentage of launches containing minus claims (such as ‘low fat’) or plus claims (such as ‘added calcium’) had dropped from a third to a quarter and from 15% to 8% of new launches respectively, said Jago, who was speaking at a Leatherhead Food Research conference on natural trends last week.

Consumers equate natural with better-for-you

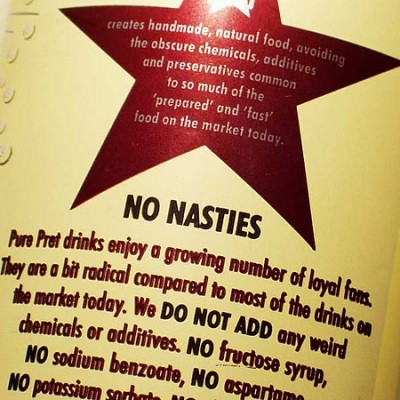

“Natural and additive-free have become part of the consumer’s health and wellness vocabulary, and we’re seeing growth in every category, from confectionery and soft drinks to meal centres.”

Rightly or wrongly, consumers also equated natural with ‘better-for-you’, he said, while the desire for greater simplicity had also prompted a flurry of launches making a virtue of how few ingredients they contained.

“A good example is Häagen-Dazs’ ‘Five’ all-natural ice cream, which only uses five ingredients that are listed on the front of the pack.”

The buzzwords connected to natural and clean-label were 'wholegrain', 'wholesome', 'authentic', 'naked' and 'bare' he added.

“The natural trend is here to stay and is essential in targeting food and drink to kids. But it can also provide a route map to premium, added-value market segments.”